Is China’s Economy Going the Way of Japan’s?

By Thomas Lambert

Staff Writer

14/2/2022

Residential buildings developed by beleaguered Chinese property company Evergrande in Yuanyang County, Yunnan Province (Picture Credit: Windmemories)

The hype around China in recent decades sometimes makes Chinese pre-eminence look inevitable, with China’s economy bound to overtake that of the US in a matter of years. The West has, however, made this kind of prediction before. For most of the latter half of the 20th century, people made similarly breathless projections about Japan. Economists predicted that by the year 2000, the Japanese economy would have left the US’ in its wake; magazines like The Atlantic even ran articles on “containing Japan” with all the paranoia of the Philippics against China today.

Japan recovered quickly from its defeat in WWII. Light industries that had been ravaged by aerial bombardment and annexation were given a new lease on life, as the new government opened the workforce to women; heavy industries, meanwhile, were nurtured by the US military’s appetite for war matériel in Korea. By the 1960s, Japan was averaging growth rates of 10% per year, with appliances from Toyota, Sony, and Toshiba filling every middle-class Western home. Since the late 1980s, however, the Japanese economy has been faltering. A major asset bubble spiralled into an out-and-out financial crisis, and despite all kinds of attempts at monetary and fiscal stimulus, growth rates have remained among the lowest in the world ever since. The “Lost Decade” became the “Lost Decades,” as the malaise lingered long into the new millennium – the sluggishness so deep and incurable that economists now refer to deflationary slowdown in general as “Japanification.” It’s a warning China would do well to heed.

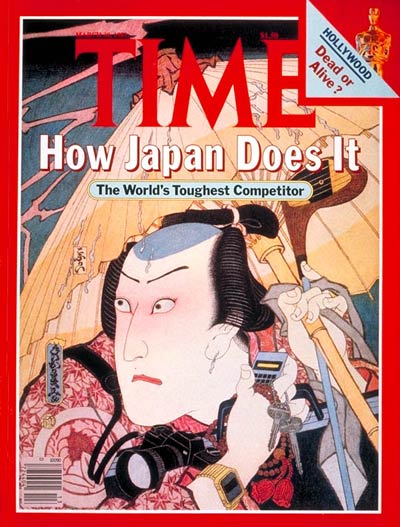

Time magazine cover, 30th March 1981

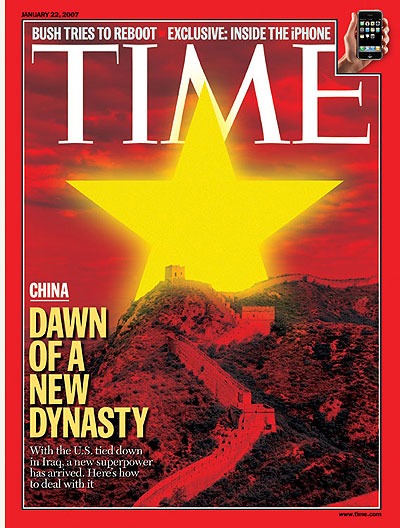

Time magazine cover, 22nd January 2007

After Deng Xiaoping introduced market liberalizing reforms in the late 1970s, China’s economy grew at an astonishing rate (an average of 9.5% a year between 1978 and 2013). Some of the most important pillars of China’s growth were its huge state-backed infrastructure projects: dams, railways, renewable energy plants, but, above all, housing. Glittering apartment complexes became models for “Socialism with Chinese Characteristics.”

Such growth, however, comes at a price. In recent months, the astonishing levels of corporate debt nurtured by China’s largest corporations (in particular, those leading China’s property boom) have attracted more and more attention. Evergrande – a housing behemoth with an estimated $300 billion of debt (around 2% of China’s GDP) – has attracted the most scrutiny, but many other companies are in similar positions: Huarong Asset Management, for instance, whose 1,333% debt-to-equity ratio has just required a massive central government bailout. In fact, a report last October by ratings agency S&P concluded that at least a third of China’s listed developers would experience severe liquidity problems over the next 12 months. And what’s more, there are signs the rot has crept into other sectors. Last year, China’s GDP grew at its slowest pace since 1990 while corporate bond defaults hit a record high, as did banks’ non-performing loan ratios. Beijing, meanwhile, has slashed interest rates to the lowest they’ve been in PRC history in a bid to keep the credit market from freezing up altogether.

The first phase of “Japanification” already seems to have begun. Nobel Memorial-winning economist Paul Krugman has described how in Japan a real-estate boom lay at the centre of a huge asset bubble, with a tripling of land and stock market prices during the 1980s. When the bubble burst, default rates exploded and a brutal credit crunch set in. Banks and private companies were simply too over-leveraged, and default rates too high, for the crisis to be contained. And crucially, for all Beijing’s state intervention, the stuttering of the Chinese real-estate market seems to be having precisely the same effects: property prices have of course already slumped, but more importantly, there has been a dramatic contraction in credit, with banks skirting regulations by replacing traditional lending with investment in low-risk financial instruments.

In Japan, the credit crunch soon burgeoned into a full-blown liquidity trap: despite lowering interest rates and putting in place an unprecedentedly expansionary monetary policy, the Japanese government failed to galvanize the economy. Demand collapsed. Between 1990 and 2003, corporate investment fell enormously, and, by 1998, Japanese firms had become net savers as opposed to borrowers. Where once Japanese companies had spent their profits on research and development, always keen to endow their products with the newest advances in robotics or computing, they now accumulated capital in its most liquid, inert form. Money sat idle in corporate savings accounts, as companies waited passively for its value to rise. And though they have yet to metastasize to such an extent, the same problems are clearly discernible in China today. Domestic demand is plummeting, and deflation is setting in. Will China manage to do what Japan failed to do in the 1990s and stimulate its way out of the liquidity trap?

There are, from Beijing’s point of view, some causes for optimism. China’s lack of a rule of law and robust private property rights affords its government far more leeway than Japan had. First, Beijing’s capacity for arbitrariness, if not downright caprice, will help reduce some of the moral hazard that’s plagued finance in the free world. The takeover of Huarong proved that the Chinese state is far more willing to swallow private corporations than its Western counterparts, and that no Chinese entity should expect to retain its autonomy in the face of infinite bailouts. Indeed, the downright ruthless way Beijing dealt with the 2015-2016 stock market crash – curbing overproduction in state-owned companies with a brutal regime that put an estimated 1.8 million people out of work – shows the dim view it takes of state inefficiency. Nor, for that matter, do notions like “limited liability,” which led to so many Western bankers and ratings agents going unpunished in 2008, have much traction in China. If companies fall afoul of Beijing’s regulatory measures, their directors can expect to be treated with all the ruthlessness that has befallen other designated troublemakers like Jack Ma and Peng Shuai.

The People’s Bank of China, China’s central bank (Picture Credit: bfishadow)

That state’s reach and lack of scruple will be advantageous in other areas too. The Chinese state has few qualms about stimulating demand artificially, and can be expected to adjust its monetary policy aggressively. The Chinese will, for instance, deliberately debase the yuan if deflationary pressures mount. Beijing does have some nominal commitments to avoid currency manipulation – notably the terms of China’s 2001 accession to the WTO – but in the two decades these have been in force it has showed scant regard for them. Whereas the Japanese were hamstrung by the 1985 Plaza Accord, which decreased Japanese competitiveness by devaluing the dollar against the yen, the Chinese will be able to manipulate the price of its exports almost at will.

Yet most of these are differences of degree. Beijing’s discouraging of reckless risk-taking may help avoid future debt crises, but will be of little use in easing one that has already arrived. On the monetary side, meanwhile, though the Chinese state may have a slightly stronger hand than the Japanese one, we should not forget the unprecedented interventionism to which Japan had recourse. In 2001, the Bank of Japan undertook the world’s first ever programme of quantitative easing – increasing its commercial bank current account balance from ¥5 trillion to ¥35 trillion ($35 billion to $242 billion) over the next four years, as well as tripling the quantity of long-term Japanese government bonds it could purchase each month.

The problem in Japan was not, at its root, monetary or regulatory, but demographic. By the 1990s, Japan’s population was one of the most rapidly ageing in the world, with over 11% of its population older than 65. Not only did the shrinking pool of young people chisel away at demand, but this higher proportion of elderly people drove up personal savings rates, enabling Japanese firms to eschew issuing stocks and bonds in favor of traditional bank loans – which extended the moral hazard endemic in the banking sector to private corporations, too.

The problem in Japan was not, at its root, monetary or regulatory, but demographic.

Like Japan, China is faced with a rapidly ageing population: even since it scrapped its famous “one-child policy,” the high cost of urban living has dissuaded couples from having more kids. In fact, according to its National Statistics Bureau, China’s 2021 birth rate of 7.52 per 1,000 people was the lowest it’s been since records began in 1949. And the demand collapse is already palpable: even by the Chinese government’s own (likely massaged) statistics, retail sales of consumer goods fell by 4% in urban areas and 3.2% in rural areas last year. Meanwhile, China shows little appetite for any of the remedies the West has typically favored – mass immigration, for instance. In any case, Chinese President Xi Jinping’s ongoing zero-COVID drive looks set to keep net migration negative at least until Beijing works out a new pandemic exit strategy. Faced with such vast structural problems, then – not just an ageing population, but massive demand collapses, declining industrial productivity, and interest rates leaving less room to maneuver than ever before – there comes a point when even the most aggressive monetary policies stop working. Japan discovered this with its QE and QQE programmes in the 1990s. China may discover the same.

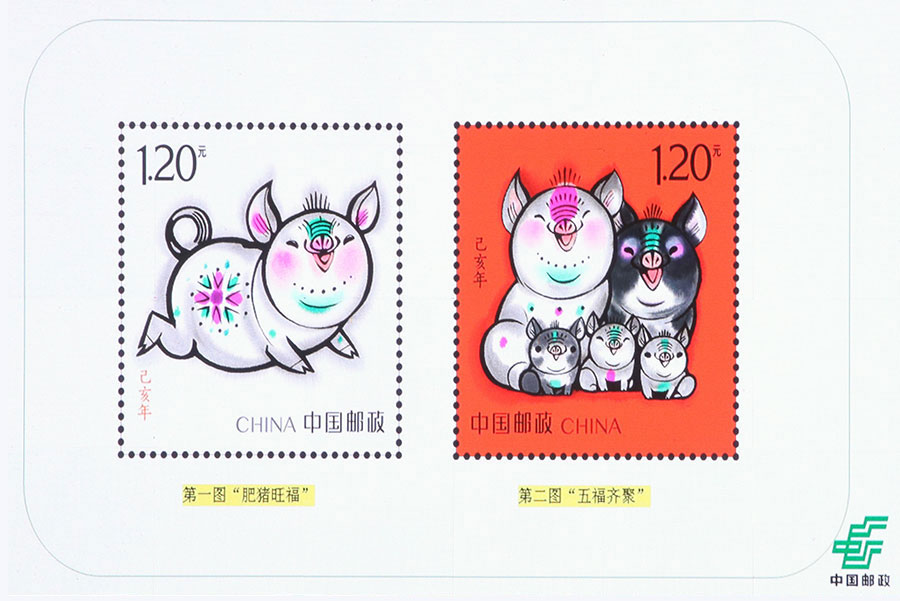

Chinese postage stamps for the Year of the Pig in 2019. The presence of three piglets was viewed by many as signaling easing birth policies, but such easing has done little to raise China’s birth rate.

There is, of course, one other way to offset domestic demand collapse: by relying on export demand for Chinese goods, which remains high. Yet Beijing seems reluctant to do so; already the Politburo has dreamed up a new buzzword – “dual circulation” – which is just a mealy-mouthed euphemism for shift in the direction of autarky, aiming as it does at “expanding domestic demand, focusing on the domestic market, improving the country’s capacity for innovation, reducing dependence on foreign markets.” After two decades fully immersed in a globalized economy – and at the very time it needs its export market most – China is starting to look inward again. Western companies are already shutting China out of their supply chains, as uncertainty surrounding the role of the state combines with fears about decreasing industrial productivity and the barriers to trade engendered by Xi’s zero-COVID policy. And though foreign investment seems stable enough for now, it isn’t hard to imagine a scenario where investors begin to grow wary as the state continues to swallow failing companies and the full implications of a new raft of regulations – most recently Xi’s big tech clampdown” – become clear.

Then there are the geopolitical pressures. The US has already sought to undermine the international credibility of companies like Huawei (in an almost play-for-play repeat, curiously enough, of the Toshiba-Kongsberg scandal that so damaged Japanese industry in 1989 – a now-forgotten episode in which Toshiba, a private company, was accused of collaborating with the heavily sanctioned Soviet state, and denied Western contracts as a result). The Biden administration has been reluctant to roll back any of its predecessor’s belligerence, retaining sanctions against Chinese officials that could very easily be extended to Chinese companies, provinces, and even the entire state itself. China, meanwhile, breaks the terms of last year’s EU trade deal every day in Xinjiang; and though it’s unlikely the current bureaucratic class will do anything about it, it isn’t hard to imagine three or four elections suddenly, and sharply, reducing European trade and investment. The “dual circulation” drive, which is largely driven by fears of Western sanctions, may partially offset the demand slump, but is unlikely to fully substitute for it.

As industries weaned on Western voracity for cheap goods adjust to a smaller, less lucrative new market, China will have to adjust to far lower growth rates than have been seen since Deng’s reforms. Indeed, if China really does continue down Xi’s autarkic path, then the slump could be even more pronounced than anything Japan experienced. And this, for Beijing, could create a legitimacy problem. China is in the process of a massive expansion of the public sector at the expense of the private sector, and while the old Hayekian arguments against central planning look decidedly weaker in an era of big data and AI, the fact remains that state-owned companies are much less efficient than their private counterparts. And if they decide to emulate the efficiency of the private sector, they will have to emulate its ruthlessness too. Departments will have to be restructured, and jobs will have to be cut. And the agent of this trauma, in the eyes of the Chinese populace, will not be the faceless board members of some private company but the government itself.

If China really does continue down Xi’s autarkic path, then the slump could be even more pronounced than anything Japan experienced.

A situation like this, as the Chinese Communist Party (CCP) knows all too well, is ripe for political turmoil. Westerners often see Chinese people as almost supernaturally passive and servile, strangers to protest and public dissent; but the reality is far more complicated. The last time Beijing attempted the kind of industrial restructuring that “dual circulation” will inevitably involve, it sparked off the greatest outbreak of civil disobedience since Tiananmen Square: a wave of wildcat strikes which began among southern factory workers in 2010, but soon spread through the entire nation, only really abating in 2015. The middle classes, meanwhile, have even more grievances. Many middle-class Chinese families have put down deposits on homes that, thanks to the Evergrande crisis, may not be built; many more will have poured years’ worth of savings into properties whose value Beijing’s new policies are sure to deflate. As Cornell political scientist Jessica Chen Weiss has shown, middle-class protest plagued Hu Jintao’s administration; they may come to plague Xi’s too.

Angry buyers demand the return of their money at Evergrande’s headquarters in Shenzhen in September 2021

Sure enough, Xi is already using old Schmittian tricks – stoking Han nationalism and paranoia towards designated enemies of the state – to distract the populace from the government’s shortcomings. At every turn, in fact, Beijing’s strategy since the wildcat strikes threatened to plunge China into crisis a decade or so ago has been to politicize the economy: not just with the crypto-nationalist “dual circulation” drive, but with Xi’s much-fêted “common prosperity” initiative. Even the slogans and symbols of the Mao era are common currency once again, as Beijing seeks to assuage public discontent at the anticipated economic downturn with messages about pulling together and finding common purpose.

This seems to be working for now. But the transition from Deng’s reformist policies back to a more redistributive, statist approach may in the coming years lead to economic stagnation, joblessness, and collapses in family wealth. If that happens, not even the CCP’s iron fist may be able to quash public anger.